Across Europe, most manufacturing sectors are considered to be at least flat. Industrial production in many of the top European economies has remained essentially unchanged since the onset of the pandemic. Yet, one industry breaks the pattern: the pharmaceutical industry.

According to Eurostat, pharmaceutical production output surged by more than 13% year-on-year in July 2025. What makes this increase interesting is not only its scale but also the source. Upon closer examination of the data, it becomes clear that most of it is attributed to only one country: Ireland.

Why this sector? Why so strong? And why now?

How Pharma is Masking Europe’s Industrial Stagnation

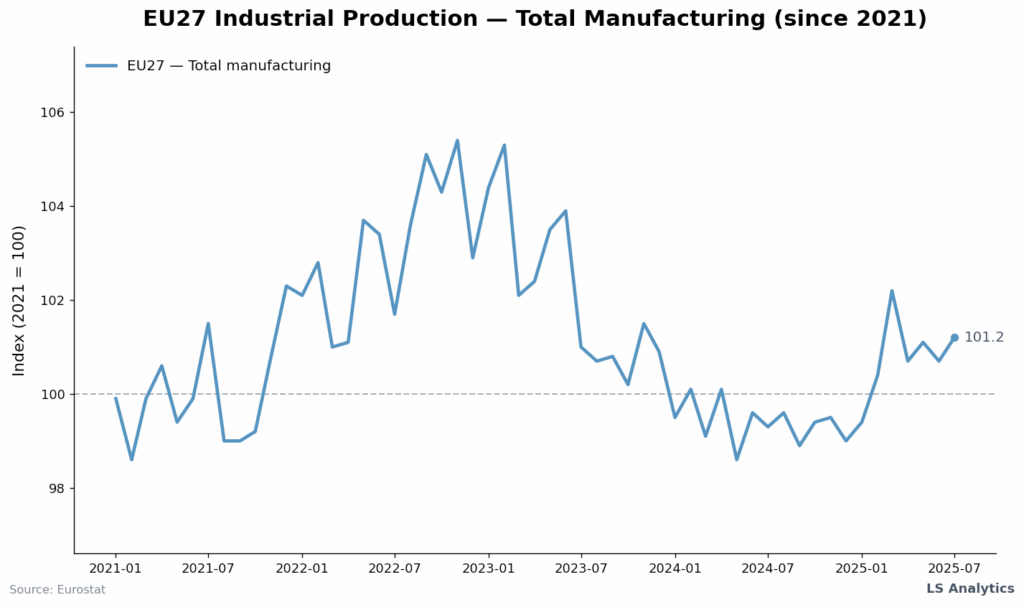

EU manufacturing experiences a relatively flat trend, with no significant upward trajectory after 2021. In July 2025, total manufacturing production is higher than during the pandemic, but only due to better performance in the first half of 2025.

But is the recovery observed in 2025 truly a sign of change in the performance of the European industrial base, which has long lagged behind its American and Asian competitors?

We are about to discover that this recovery isn’t shared evenly across European industries and countries. The aggregate data obscures the actual cause of at least part of this rebound.

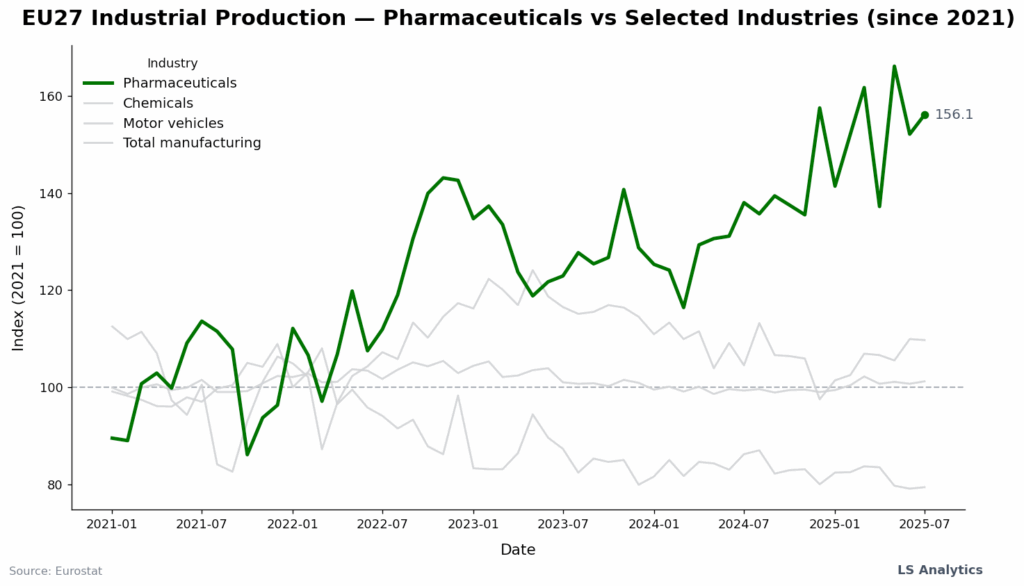

Let’s take a look at the chart below, which breaks down industrial production into several major industries. What’s striking is the comparison between the pharmaceutical industry and the others.

A Sector Apart: Pharma vs. The Rest

While Europe’s automakers struggle to regain lost ground, the drugmakers show a powerful performance.

Pharmaceutical production is diverging significantly from total manufacturing production in Europe. This industry has not been significantly impacted by the problems experienced by other sectors, including the energy crisis and weaker internal demand.

There are numerous reasons to believe in the pharmaceutical industry’s strength. The demand is strong and global. And in theory, pharmaceutical production, due to its higher margins, might be less affected by energy prices.

And this all sounds like a European pharmaceutical miracle. However, the story doesn’t end here. The epicentre of this spike is quite heavily concentrated and not necessarily due to Europe-wide trends.

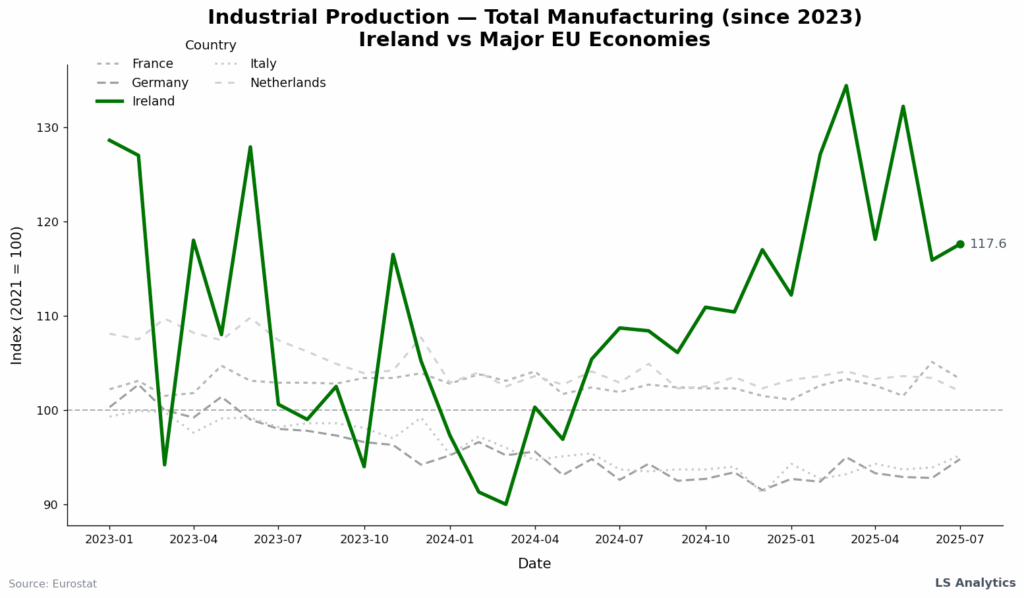

The Irish Hub

Traditionally, Germany has been considered a European industrial powerhouse. The recent data show a completely different story. The German industrial production is not very impressive. We can observe a similar, flat production trend across the major EU economies – Italy, France, and the Netherlands are not driving the increase in manufacturing growth.

To identify the engine driving European manufacturing growth, we can turn our attention to Ireland. This relatively small country has experienced a very impressive manufacturing trajectory. This growth began not long ago, in mid-2024.

Apart from the recent impressive growth, we can notice the volatility in Irish industrial production. It jumps much more than in similar countries in Europe. Why is that?

The reason lies in the structure of the Irish economy. Many American pharmaceutical companies have their manufacturing hubs in Ireland. Companies like Pfizer, Merck and Eli Lilly have their plants in Ireland. The country produces far more medicines than it could consume, so most of the output is shipped abroad.

It also explains the volatility in the Irish data. A shift in production, even in a single factory, can move the entire national index of industrial production.

It tells us a few things. First of all, Ireland is deeply exposed to the decision of a handful of multinational firms. And it can make the economy vulnerable amid geopolitical and trade tensions.

The Catalyst: Rushing Before American Tariffs

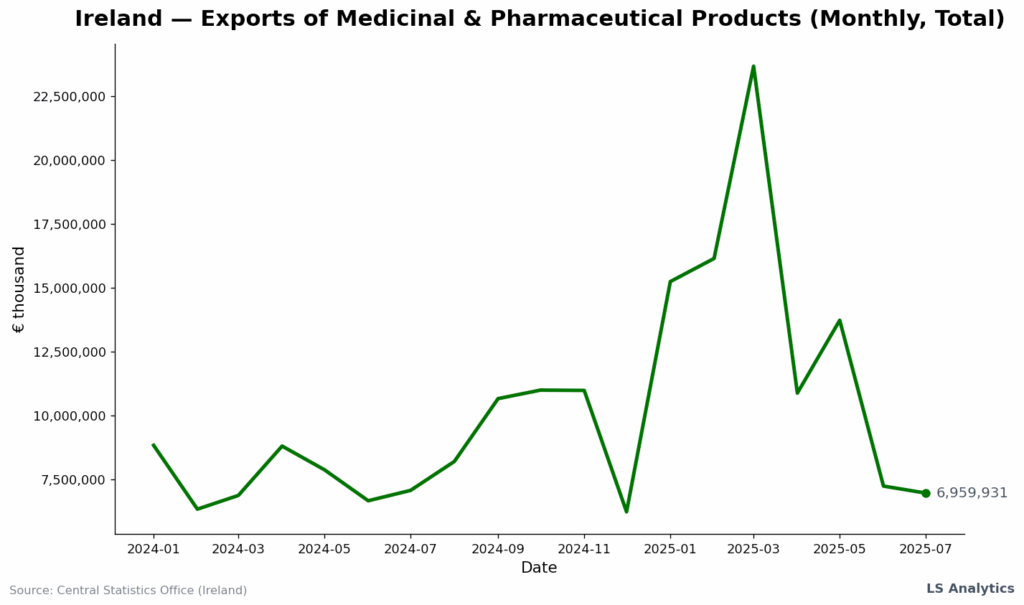

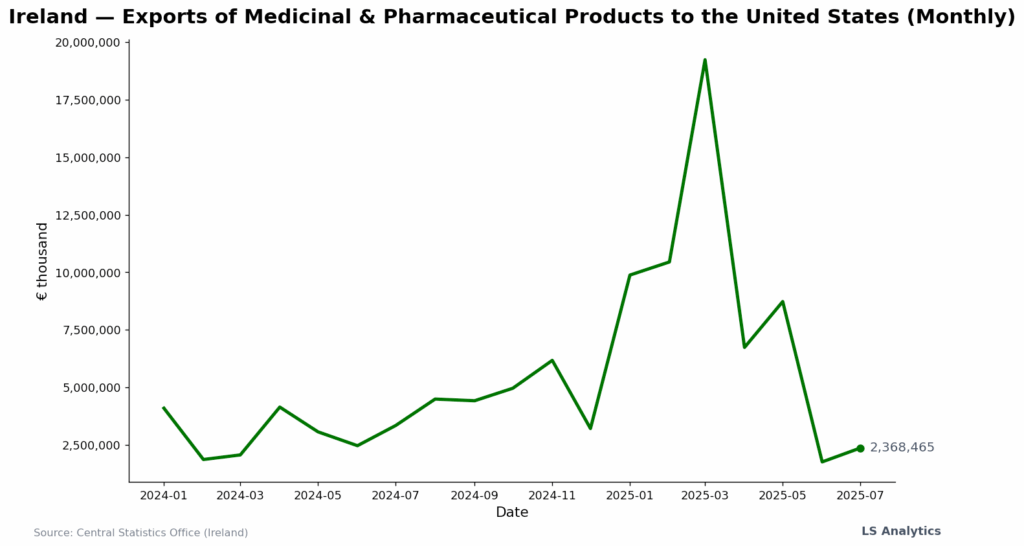

Trade data obtained from Ireland’s Central Statistics Office helps us explain the causes of the Irish growth.

At the beginning of 2025, the import of pharmaceutical products skyrocketed, which correlates with an increase in the manufacturing data.

We can clearly see that when Irish exports surged, European industrial production also increased. Is it a causal effect? We can’t be certain, but it’s undoubtedly a fascinating incident which is most likely not random.

Digging deeper into the Irish trade data allows us to identify the actual root cause of the rise in exports and, in turn, the increase in industrial production. And the reason lies on the other side of the Atlantic Ocean.

The Irish pharmaceutical export to the United States peaked in the first half of 2025. It shows that companies based in Ireland, many of which are American, increased their production to export medicines to the American market.

It shows that many US pharma companies manufacture their products in Ireland, benefiting from the low tax regime and skilled labour force. However, the output of this production is destined to be sent back to their home base in large quantities. Irish factories are technically and geographically in Ireland, but their customers are American.

However, it is not a new story; it’s a characteristic of the Irish economy. What’s interesting is why it happened in 2025. The upcoming trade war and the increase in the American tariff regime might be the reason.

The threat of tariffs announced by President Donald Trump prompted American companies with factories in Ireland to increase their production destined for the American market, aiming to avoid a temporary increase in tariff costs. Can we prove this argument directly? No, but it is a valid hypothesis based on the existing data, combined with current geopolitical and trade developments.

The Exposure to Geopolitical Volatility

It clearly reveals the Irish economy’s dependency on the American market. The tariffs are a sign of souring moods towards globalisation, which might harm the Irish economy.

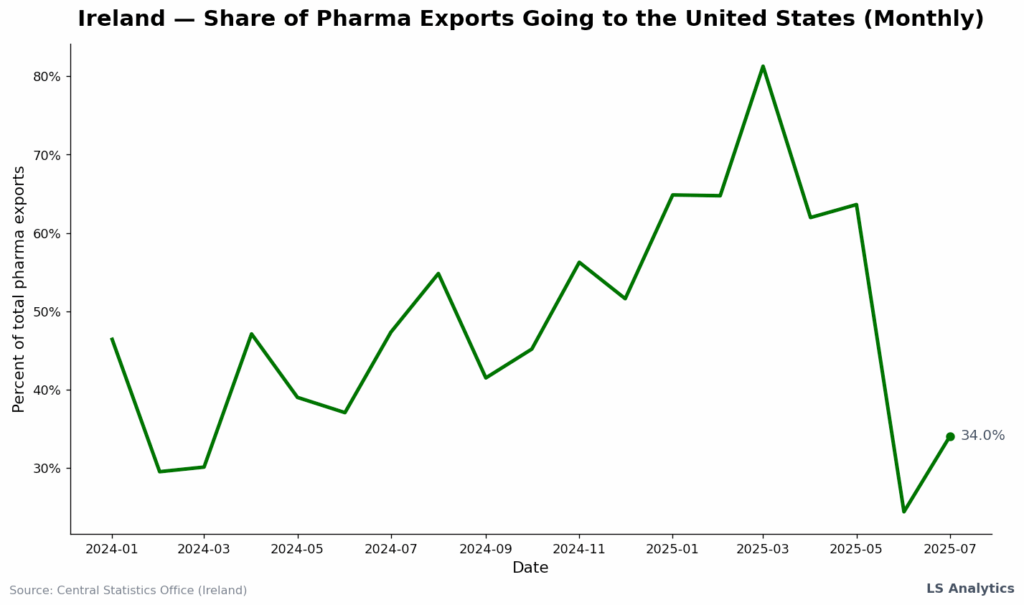

And we can see this by examining the share of Irish pharma exports. At the beginning of 2025, over 80% of Ireland’s pharmaceutical exports were directed to the United States. It clearly supports the rushing before tariffs hypothesis.

The volatility of Irish export data and industrial production is also exciting. Such a dependence makes Ireland, as well as the EU’s industrial numbers, vulnerable to US policy shifts.

And let’s also see what’s happening later in 2025. The Irish exports of medicines have plummeted to one of the lowest levels in the last 2 years. This decrease directly corresponds to a decline in exports to the US, from 80% to 34%.

Such volatility is striking and demonstrates how trade policy can quickly impact trade and production data. Let’s also see if this is going to be a long-lasting phenomenon or short-term volatility. If exports to the US decline, it might harm the Irish economy, highlighting its heavy reliance on the American market.

Conclusion: A Success Story Dependent on Washington

Ireland’s pharmaceutical boom is an extraordinary achievement. It has transformed a small island into one of the world’s leading drug exporters, enriching government coffers. However, despite such success, we can also identify its more fragile foundations, such as foreign ownership or dependence on American demand.

The data also reveals an additional thing. The leading industrial powerhouses do not drive the European production recovery, and it is not distributed evenly. The observed manufacturing recovery is primarily due to demand from the other side of the Atlantic, driven by activities of non-European companies. It shows that the road to regain European competitiveness on a large scale is long, but still possible.

However, for now, we can see one thing: Europe’s strongest factory is not in Germany or France, it’s in Ireland. And the further fate of it might not only be decided in Dublin or Brussels but rather in Washington.