On 22 January 2023, Cristiano Ronaldo made his first official appearance for Al-Nasr against Al-Ettifaq. It seemed like just another match, but it marked a pivotal moment in the history of modern football.

The match showed the Saudi Pro League’s ambition to become a football powerhouse, driving major spending to attract global stars and challenge the established order.

This story explores the intersection of sports and geopolitics, with a focus on Saudi Arabia’s economic aspirations that extend beyond oil exports.

How has it worked so far? Did the Saudi Pro League achieve a status in the football world after over 2 years? Or will it fail like a similar football experiment performed in China?

Spending

Transfers of football players are one of the most interesting aspects of this sport, sparking numerous discussions and generating headlines. Transfer spending is one of the leading indicators of the wealth and power of the given league.

After all, only the wealthiest and most powerful football clubs spend hundreds of millions on new players. And usually, those are the clubs from established, strong football markets in Europe, led by England. The Saudis challenged this status quo.

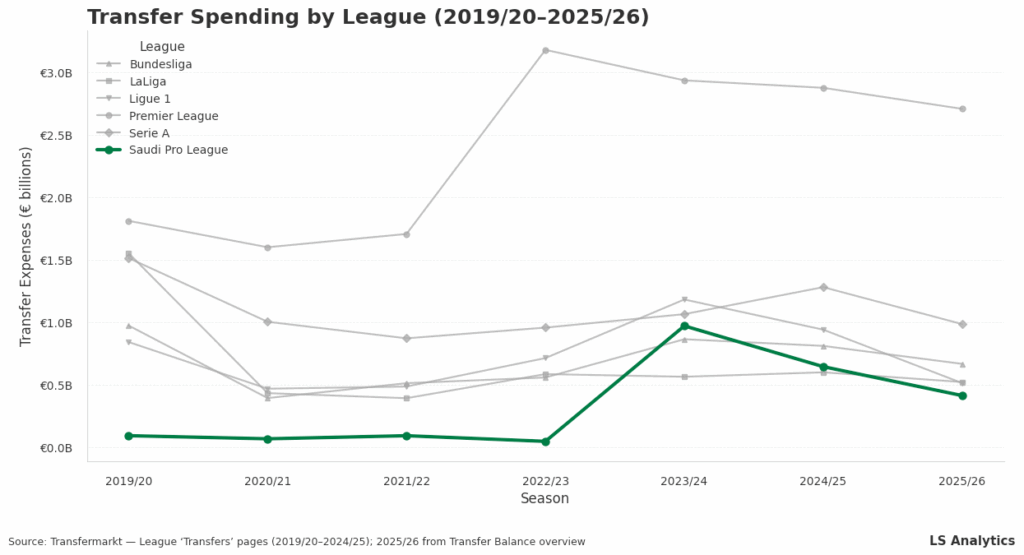

In the 2023/2024 season, Saudi Arabian teams spent almost €1 billion on transfers, ranking fourth in the world and outspending top teams from France and Germany. Spending decreased afterward but remains significant, highlighting the league’s challenge to the established order.

To illustrate the scale, compare with China’s 2016 football spending. China’s attempt to challenge global football ended in financial trouble and retreat.

Conversely, Major League Soccer’s steady growth over the past few decades offers a slower, possibly more sustainable approach. These comparisons highlight Saudi ambitions and raise questions about the league’s long-term strategy and viability.

This raises a key question: Has this investment yielded clear, measurable success for the Saudi league?

Attendance

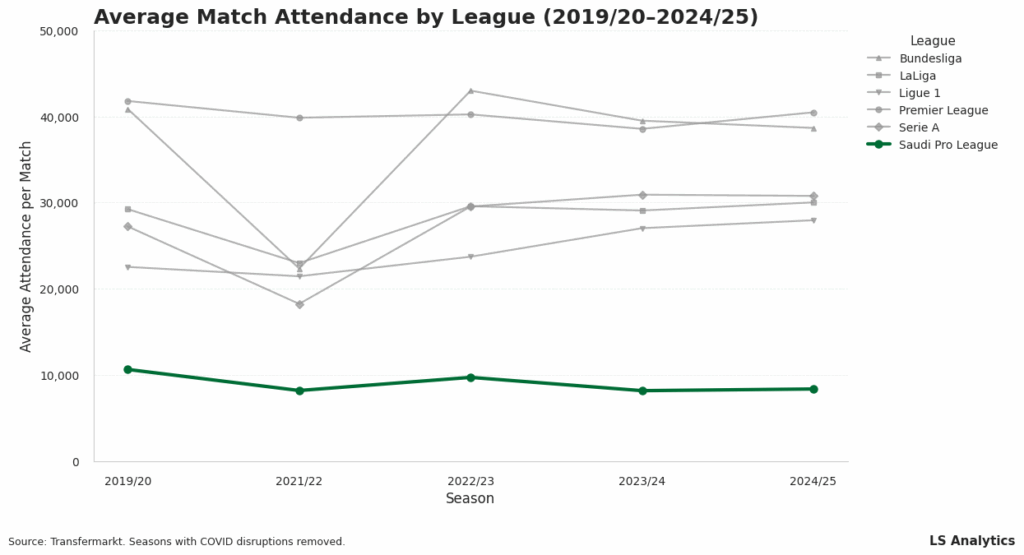

Football exists to entertain fans. Stadium attendance is the best measure of a league’s appeal. Spending is pointless if it fails to draw crowds.

The following chart presents the average attendance trends for the Saudi Pro League compared to the other top football leagues. Attendance peaked in 2022/2023 after stars like Ronaldo arrived, but soon returned to prior levels.

The league did not sustain high attendance after the initial rise, possibly due to stadium capacity limits or the challenge of drawing more local fans.

Despite significant spending and a slight attendance spike, the Saudi League’s overall crowd numbers remain moderate compared to other top leagues, influenced by the country’s size and football traditions.

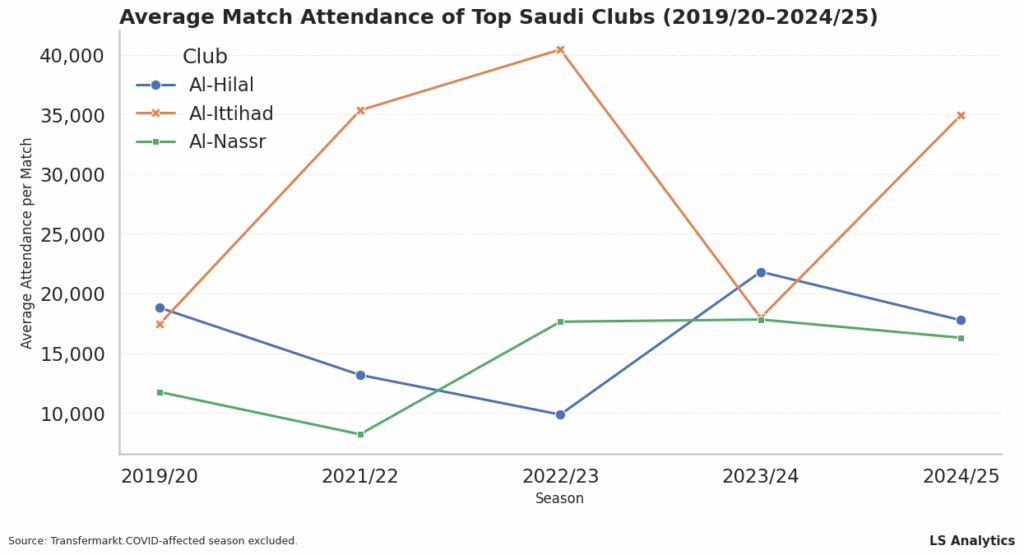

Maybe it’s better for the top clubs that spend the most money?

Yes. Top clubs experienced significant attendance gains following substantial spending. And it shows that the Saudi league is divided: top clubs attract crowds, others lag behind.

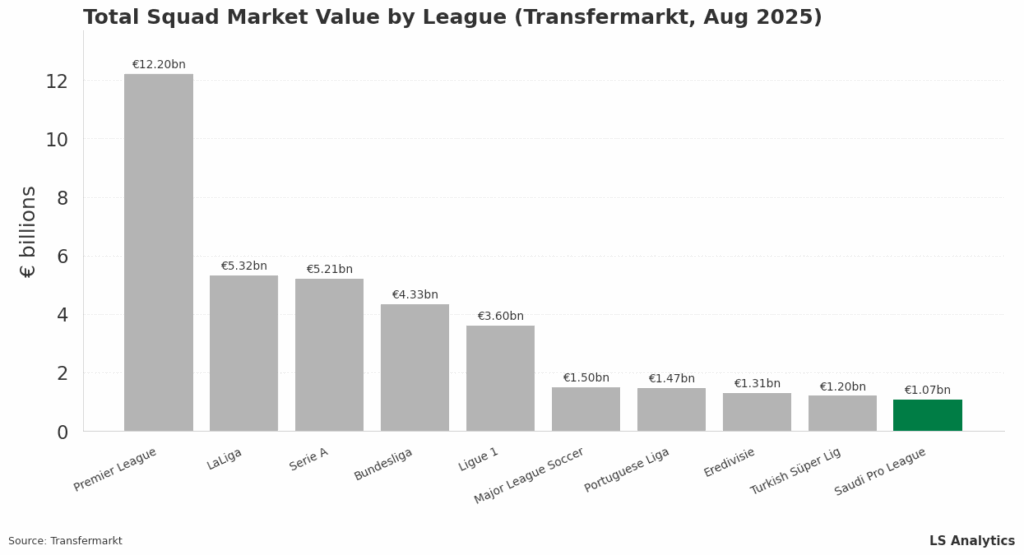

Teams quality

Football’s success is also judged by performance. Comparing teams internationally reveals a league’s progress.

Unfortunately, we can’t compare the Saudi clubs with their European counterparts due to the lack of sufficient international football competitions of this type.

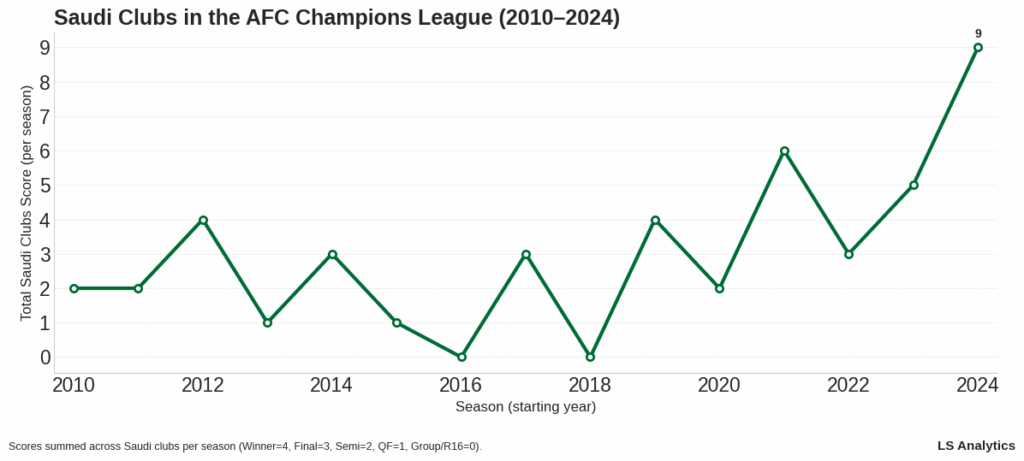

However, the performance of Saudi clubs can be measured against that of other Asian teams. They compete in the AFC Champions League, the Asian equivalent of UEFA’s Champions League.

To achieve this, we can utilize a straightforward scoring system. Each Saudi club in the ACL is given a score depending on the stage they reached:

- 1 point for quarterfinal

- 2 points for the semifinal

- 3 points for reaching the final

- 4 points for winning the competition

This scoring isn’t perfect, but it gives a general view of a country’s performance in continental competition.

Overall, Saudi Arabian clubs perform well in the AFC Champions League.

After 2023, Saudi clubs saw improved performance in the AFC Champions League. Their performance culminated in 2024/2025 season when Al-Ahli won the continental competition with Al-Hilal and two other clubs in semi-finals. Saudi Arabia totally dominated AFC this season.

While this increase aligns with higher spending, it does not necessarily prove a direct link. However, it does show correlation between investment and performance, leading to a superior sporting results at the continental stage.

Google Trends

Saudi clubs aren’t spending only to compete in Asia. If you bring in global stars, you want global reach.

Can we check easily using the available data? Unfortunately, it’s challenging because there’s no precise trend data available for the Saudi Pro League’s global viewership. Using social media metrics, such as Instagram followers, is also not the best option, as this number obviously skyrocketed by signing Cristiano Ronaldo alone.

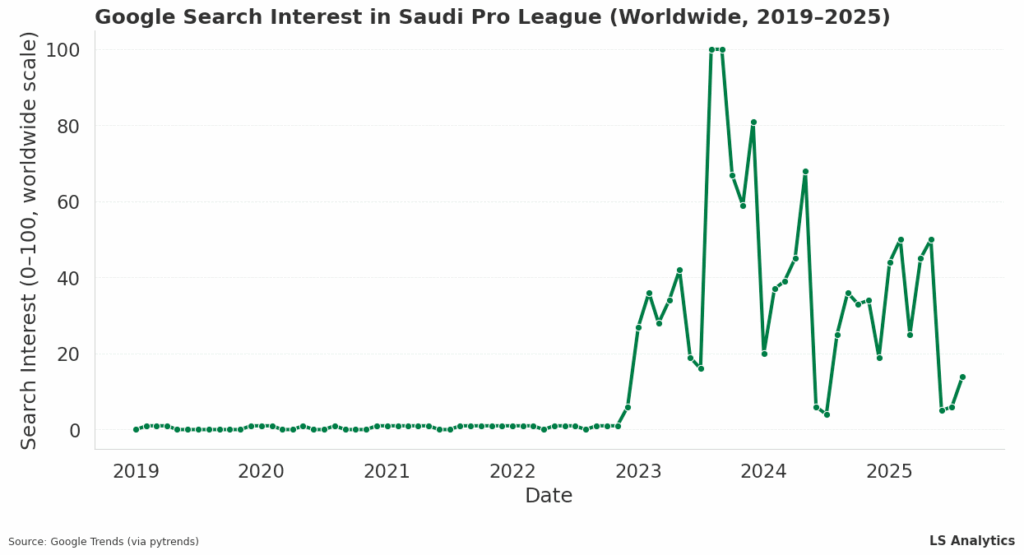

Google Trends, however, provides a great proxy for assessing the interest generated by given topics worldwide.

Interest in the Saudi Pro League grew sharply after 2023, as more global stars joined. However, this interest soon declined, and although it remains above 2019 levels, it is trending downward in 2025.

A point of concern for Saudi club owners is that interest, although higher than 2019 levels, has declined since its 2023 peak. As of 2025, these downward trends continue.

Interest in the Saudi Pro League peaked in 2023 but has since decreased. Attracting renewed interest may require signing more famous players.

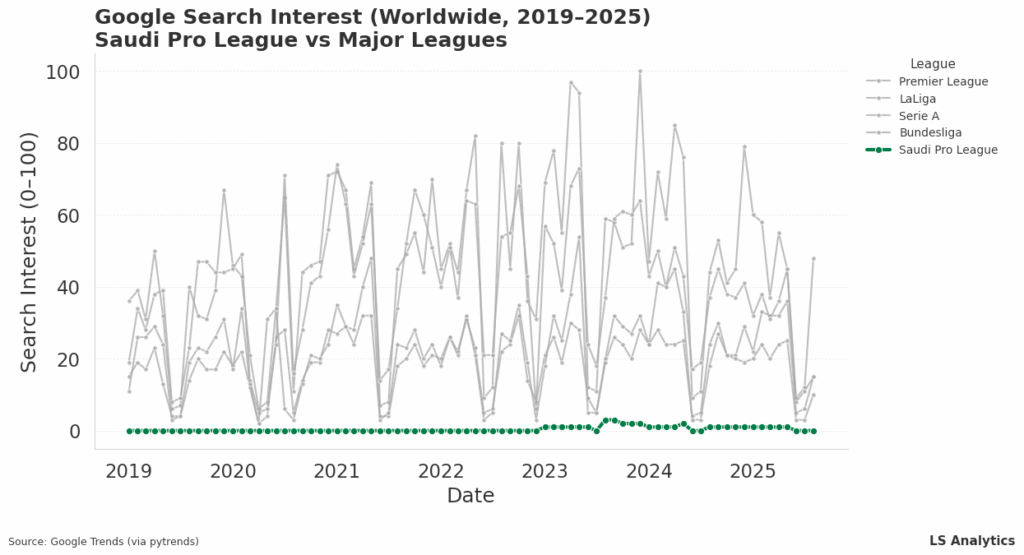

The Saudi Pro League’s peak interest remains significantly lower than that of the top leagues, according to Google search comparisons.

Summary

One might argue that comparing the Saudi Pro League to the top five leagues in the world of football is unfair, given that those leagues are the most established and traditional. They have been and will continue to be the main forces in football. But why not? Saudi Teams are spending money that is competitive with the top five leagues. If you’re spending like big players, you have to be compared to them.

Currently, the Saudi League remains far from achieving parity with the top European leagues. While spending has increased attendance for top clubs, overall fan interest, as measured by global indicators such as Google Trends, has leveled off. This suggests that, despite investments, the league has yet to achieve the status or competitive balance needed to justify its ambitions.

On the other hand, Saudi teams perform well in the Asian Champions League. They still have money and are willing to spend it, as evidenced by the current transfer windows. What’s essential is that teams from Saudi Arabia try to attract not only former football players, but also relatively young and promising players. And the salary they offer is definitely very competitive. Such a strategy requires a lot of money and hinges on one crucial question.

The Saudi Pro League, despite significant efforts, still trails the top five leagues in competitiveness and appeal. Its most realistic strength is as a destination for fans interested in star talent, which may attract tourists and support economic goals, but does not yet match the elite leagues.

To achieve its long-term goals, the league must improve overall competitiveness and increase attendance at all clubs. Without clear progress on these fronts, the investment is unlikely to deliver the intended global impact or relevance.